Investment Profile Questionnaire

Private and Confidential

In order for an Adviser to make a sound financial recommendation, the Adviser must conduct an appropriate investigation of your particular needs and financial situation. The information requested in this form is necessary to enable a recommendation to be made that is considered to be in your best interests.

WARNING: If you do not provide complete and accurate information that is relevant to financial needs as requested in this form, the Adviser may not be able to give you an appropriate recommendation.

All Amalgamated Financial Services will adhere to Privacy Act 1988 including the Australian Privacy Principles when collecting, using, storing and disclosing the information contained in this form and will not unlawfully disclose this information.

You are entitled to gain access to this information and should you wish to do so, you can contact your Adviser.

What is an Investment Profile?

Investing can invoke strong emotions in all of us. Even the most seasoned investors worry about market volatility, time in the market and the impact decisions can have on long term plans. It is important for us to understand your attitude to investing and different investments.

An Investment Profile is a way of finding out a person’s willingness or reluctance to take on risks.

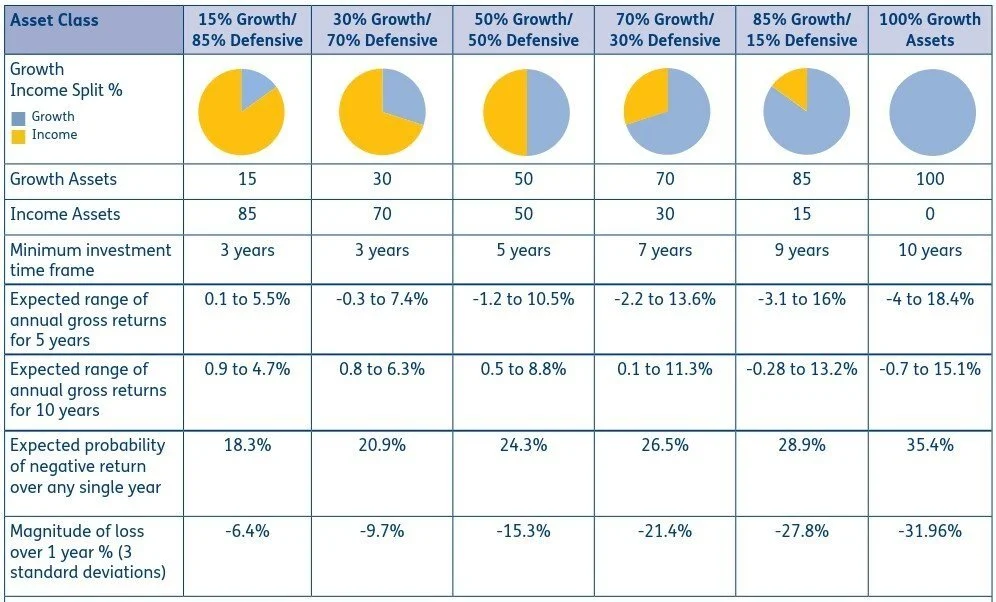

There are six Investment Profiles to choose from, each with their own risk and return characteristics.

Each Investment Profile is linked to investment asset class allocations.

These Investment Profiles are designed with reference to Morningstar Research, which provides historical and forecast data on risk, returns and asset classes.

How does my Adviser use an Investment Profile in their recommendations?

Once your Investment Profile is agreed, your Financial Adviser will recommend specific investments which reflect the asset allocation and risk characteristics of your Investment Profile.

Focusing on Asset Allocation

Asset allocation is a way of investing in a mix of investment types or classes such as Cash, Fixed Interest, Shares, Listed Property and Alternatives/Infrastructure. Since Australia makes up less than 2% of the world economy, asset classes can be further broken down into International and Australian.

Main Asset Classes

Risk and Return trade off

Investment decisions involve taking risks. In planning to meet your goals, objectives and future needs, you need to consider what level of risk you are willing to take or tolerate to achieve your aims.

What is risk and return?

Return is the reward received for investing. It can be income such as dividends or an increase in value or growth of investments. Risk is the possibility of losing money, real or unrealised. The graph below demonstrates the higher the risk, the higher the potential return.

There are 3 main risks you need to consider:

Inflation

Where inflation or the cost of your lifestyle expenses exceeds the return of your investments. A low-risk investment like ‘cash’ with a fluctuating interest rate can be eaten away at by inflation at times. This effectively reduces the purchasing power and ability to fund lifestyle and expenses based on savings alone.

Investment

Where the performance or return of your investments does not meet the income and/or growth expected and potentially you end up with less than when you started (loss of capital). Specific investments may have other risks.

Volatility

Is the ability to ride out fluctuations in value and performance of investments.

Diversify to reduce risk

Diversification is investing into a mix of different asset classes and even underlying funds, fund styles, companies, industries and economies around the world.

The table below shows asset classes in order of best to worst performance since 1990. Green is the best performing year for the asset and red is the worst. History shows you can’t predict with certainty the best performing investment year to year, so don’t try.

Time in the Market, not timing the Market

The length of time you wish to invest – your investment time horizon - is critical to improving the probability of meeting your investment goals. You need to consider when you may need to cash in your investment or start to draw an income.

The chart below shows the performance of various asset classes over the last 30 years. As you can see, all asset classes increase over the long term. The chart also illustrates the benefit of diversifying investments across asset classes to help reduce volatility and smooth out returns over time. Blending asset classes over longer time horizons helps reduce risk.

Volatility

Market volatility refers to the movement of the value of investments in the market. Sometimes the values can move rapidly, and this movement can be stressful for investors when they see these values rise and fall quickly. Although market volatility is out of your hands, it can impact on your personal financial situation. There are two types of volatility:

Value Volatility - the value of growth investments fluctuates. This in the short term can be a concern but long-term asset values eventually rise as can be seen from the chart. What is important is investing in the right asset class for the length of time you intend to invest to minimise the chance you need to sell down an investment at a low point.

Return Volatility - changes in the return or income received from investments. This is extremely important where you are relying on the income from investments to fund your lifestyle like in retirement.